resources

- Insights

- Knowledge Base

- Media Hub

Airbnb, An Analyst's Guide: Going Public, Revenues, Business Model & Statistics

Airbnb has come a long way from when CEO Brian Chesky and his friends converted the living room of their San Francisco apartment into a bed & breakfast with the help of an air mattress in order to help pay the rent.

Going into 2020, Airbnb was a behemoth in online travel with around 13,000 employees and 31 offices around the world. Airbnb had hosted over 400 million guests since its launch and had both supercharged the short-term rental industry and completely disrupted the online accommodations industry. The company had entered a number of complementary businesses, including experiences.

On its journey, Airbnb created an untold number of jobs, stimulated economic activity in once-forgotten neighborhoods, created a new class of entrepreneurial Airbnb property managers and made cheap and unique travel experiences available to everyone. At the same time, it had been criticized for a wide variety of issues from worsening the housing affordability crisis, to damaging the hotel industry, to impacting tax compliance, and a range of other issues, many of which the company had taken steps to ameliorate.

As the coronavirus pandemic started to sweep the globe in 2020, confusion reigned and it wasn’t clear what the future was for short term rentals in a post-COVID world. Airbnb saw bookings and revenues decline massively and carried out painful cost-cutting measures.

Then the unexpected happened. Airbnb, and the short-term rental industry in general, staged a big comeback as we moved into the summer of 2020, as short-term rentals started to emerge as a potential winner in the huge shakeup of travel that followed from the onset of the virus. In response to COVID and weary of lock downs, travelers favored social distancing-compliant short-term rentals which offered a form of accommodation that allowed guests to choose who they would be around and avoid the crowds and multiple personal interactions involved in staying at a hotel. This made it even more difficult for hotels to compete with Airbnb.

Here at AllTheRooms we used our Airbnb statistics to track the recovery using our Forward Booking Index tool, and reported it to the press**.** This tool allows us, and our clients, to see how bookings and occupancy rates for Airbnb and the short-term rental market are developing up to 365 days into the future.

|  |

| The AllTheRooms Analytics Forward Booking Index: USA & Europe Forward Occupancy Curves – 07/16/2020 | |

In July of 2020, Airbnb stated that it’s plans to launch an IPO that year were back on track**.**

Now with Airbnb looking at going public and taking its growth to the next stage, investors are taking a long hard look at Airbnb and its future growth potential. As a leading provider of data and analytics for the short-term rental industry, AllTheRooms Analytics is uniquely positioned to provide insights into Airbnb and it’s operations, some of which we will share below.

Airbnb's Business Model

Airbnb's Business Model Involves Two Customer Segments

Hosts – this can be either people who want to offer their entire home, a private room or a shared room on a short-term rental basis, or people who want to host an ‘experience’. Sometimes these are combined.

Travelers – people looking for accommodation for a vacation, business trip or anything in between, who come to Airbnb’s site or app and search for a property they like that is available on the correct dates.

How Airbnb Works in Simple Terms

The Host lists their property/room on the platform and provides key information about their listing, including what price they charge, what amenities the property has, and a description of the property, in addition to information on themselves as a host.

A traveler comes to the site or app, chooses a listing that they like, and hits book.

The traveler then pays the rate that the host decided plus ancillary charges such as a cleaning fee, a security deposit, and a guest fee.

The host approves the booking (although in the case of instant book, the booking is instantly approved), and then Airbnb transfers the host’s revenue from the booking to the host, taking their commission cut.

Airbnb Fee Structures

Airbnb offers three main commission structures.

Shared Host & Guest Fee – The host pays a service fee of 3% of the booking subtotal (including the nightly rate, cleaning fee and additional guest fee, but excluding Airbnb fees and Airbnb taxes), although it can vary in other countries and for Airbnb Plus hosts. The guest pays a service fee of around 13% of the booking subtotal, depending on a number of different factors.

Host-Only Fee – The host pays a service fee of between 14-20%.

Airbnb Experiences – The host pays a 20% service fee based on the pricing of the experience offered.

Target Audience

As we can see from our vacation rental guest demographic data, Airbnb is most widely used by Millennials, who make up the bulk of the millions of travelers using the platform. Millennials (defined as those born between the mid-1980s through to late 1990s) are big travelers and much more open-minded to different accommodation types and travel experiences than older cohorts. Millennials are also commonly cost-conscious, and Airbnb rentals are often much cheaper options than staying in a hotel.

Airbnb Guest Demographics

|

| A typical age distribution that we see in our vacation rental guest demographic data. |

Retention

While the majority of travelers have heard of Airbnb, a challenge for the company is how to make sure users keep coming back.

In order to do this, Airbnb has continued expanding its offering with more unique homes available to rent, better insurance policies, and extra products such as Airbnb Experiences, where travelers can sign up to local experiences for a deeper immersion into their destination during their stay.

The company has made the platform simple to use, with a great interface, Instant Book feature, and plenty more — all of which accumulate in an enjoyable user experience and a higher likelihood of returning visitors.

Adding More Listings

So, how does Airbnb convince people to open up their homes to the platform and offer accommodation? For many, the idea of making money from a spare room is very appealing, however, at the same time, many people feel nervous about letting strangers into their properties.

Airbnb’s insurance policy plays a large part in the company’s success in flooding the market with vacation rentals. Airbnb has a Host Guarantee policy which means every property is insured by up to $1 million USD at no additional cost. With the Host Guarantee policy, thousands of homeowners have the assurance that their home will be covered in the event of damages. Unsurprisingly, this has been a significant factor in encouraging hosts to list their place with Airbnb.

Equally, Airbnb’s free-to-list business model means that homeowners have nothing to lose by listing their property on the platform. It’s a great way to convert hosts who are curious about the money they could make but don’t want to commit immediately.

Airbnb Plus

For travelers who aren’t keen on staying in someone else’s ‘homely’ home, there’s Airbnb Plus. This offers accommodation in an Airbnb home that’s more luxurious than your average rental and can be categorized somewhere between a home rental and a hotel.

Airbnb Plus offers high-end properties that have been personally verified by Airbnb for quality, design, and comfort. The properties come with many of the things you would expect to see in a high-end hotel room, such as good quality towels and sheets. They have also been specially-designed to be as visually appealing as possible. Airbnb Plus properties boast great reviews and are known for their attention to detail. Using in-person quality inspection, the company assures that the property is fit to be an Airbnb Plus property.

For travelers who don’t like the idea of staying in another person’s home, Airbnb Plus is a great product that caters to those expecting hotel standards. By introducing Airbnb Plus, the company has found a way of attracting travelers who have previously not used the platform.

Airbnb Experiences

Airbnb Experiences is an example of the company branching out from just selling one product — accommodation — into selling destination-based experiences. As a traveler, if you want to sign up to a city walking tour, go on a food tour around a certain neighborhood, or go dancing in a local club, you can do so through Airbnb experiences.

This is one of the most successful additions to Airbnb’s business model in recent years. Airbnb has revolutionized the travel industry by positioning themselves as a travel experience, instead of solely a functional short-term rental site, which is how the majority of online travel agents are positioned.

Airbnb Growth Statistics: 2019

AllTheRooms Analytics tracks all key performance indicators for individual Airbnb properties, including revenues, occupancy rates, average prices, and supply in any given market. As a result, we are able to accurately predict the earnings of Airbnb and companies like it, and also provide in-depth analysis into its operations.

How Many Listings & Hosts Are On Airbnb?

As of writing, Airbnb has close to 650,000 hosts using it’s platform and around 6.1 million listings. Compare that to June of 2018 when there were about 4.4 million listings on Airbnb and you can see that Airbnb has continued to grow its inventory at a remarkable pace of almost 40% in the last year alone.

What’s perhaps even more notable is that rapid growth in instantly bookable listings on Airbnb, which is as of writing up to 3.6 million listings – a 62% rate of growth year on year. We’ll go into why this is a big deal and how this has helped Airbnb dominate later on.

How Many Bookings Does Airbnb Generate?

The above chart shows the number of room nights booked on Airbnb’s platform. In Q2 of 2019 alone, travelers used Airbnb’s platform to book almost 100 million room nights.

Airbnb Revenue: How Much Revenue Is Airbnb Generating?

The first observation you could make looking at the above graph is that there’s clearly seasonality in Airbnb’s revenues, which makes sense. Airbnb’s biggest markets (Europe and USA) tend to attract the most travel during the summer and that gives you the peaks and troughs in revenues.

The next observation is that Airbnb’s revenues are growing pretty spectacularly – close to 40% year-on-year growth in Q2 of 2019 vs. 2018.

Given that Airbnb is still not a public company (more on that later), it doesn’t need to publish full financial statements. However, the company does provide some data on revenues.

In Q2 of 2019, Airbnb reported that it had made more than $1 Billion in revenue. Taking our gross revenue numbers for Q2 and multiplying it by their known composite fee structure, we get close to $1.2 billion, which makes sense. It’s only the second time in the company’s history that they have reported quarterly revenues in excess of $1 billion, the last time being in 2018.

What Are Airbnb's Booking/Occupancy Rates?

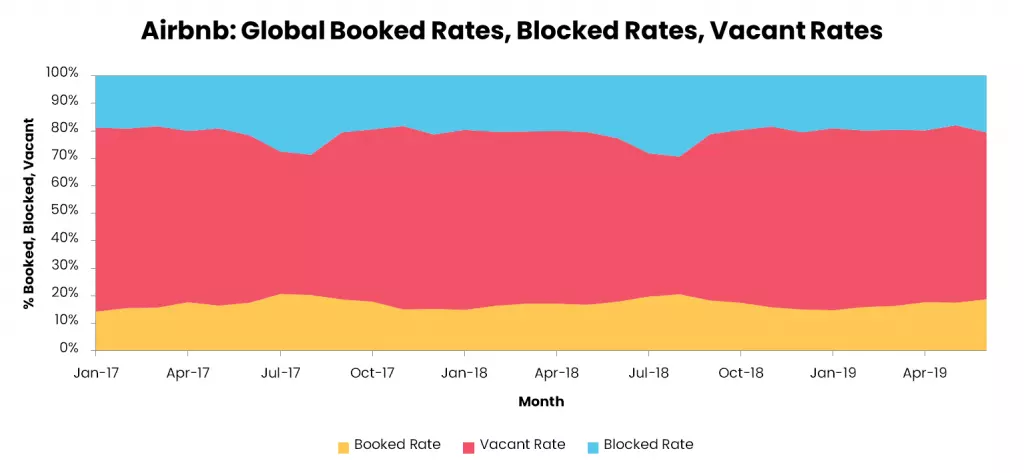

Airbnb’s booked, blocked, and vacant rates can be seen in the chart above. As you can see, they have all stayed fairly constant throughout our data set.

Booked rates (occupancy rates) tend to fluctuate between 15-20% at a global level, while listings on average remain without bookings around 65% of the time. Hosts tend to block their property’s calendars around 20% of the time.

These Airbnb occupancy rates may seem low, especially if you look at professional property managers who tend to aim for around 70% occupancy rates for their short-term rentals, one must take into account that on a platform like Airbnb bookings are not distributed equally. That is to say, the desirable and often professionally managed properties tend to get the majority of bookings, and there’s a huge tail of lower quality properties with very few reviews and low desirability, not to mention a large number of inactive and dormant properties.

What Is The Average Daily Rate On Airbnb?

The average price, nightly rate or average daily rate of listings on Airbnb stays pretty consistently around $100/night.

However, that figure includes every listing. There’s a huge variety of properties on Airbnb – from a bed in a shared room in someone’s apartment to luxury penthouses and huge party mansions.

How Is Airbnb's Revenue Split Geographically?

Airbnb’s biggest markets, as we mentioned earlier, are Europe and the US. Asia-Pacific sits in a distant third place.

But which markets are growing fastest for the company? Looking at year-on-year Q2 revenues in 2019 and 2018, Latin America takes the crown with growth of 54%, then Asia-Pacific at 52%, followed by North America at an impressive 48% and Europe coming last at 26%.

Airbnb & Instant Book

The introduction of Instant Book by Airbnb has placed them in a position where they could dominate the OTA industry in the near future. The feature, which improves conversion rates and helps the company to crowd out the market, has grown dramatically with close to 60% (as of Q2 2019) of Airbnb’s total inventory now listed as instantly bookable.

Since its introduction in 2014, the Instant Book feature has hit the ground running. Instant Book inventory now stands at close to 3.6 million units as of June 2019. This means that over half of Airbnb’s total inventory is listed as instantly bookable – and this has happened in a very short space of time. Given the rise of Instant Book, it’s likely that in the future an even larger proportion of listings on the site will be instantly bookable.

Defying Market Saturation

While Airbnb continues to grow at a healthy rate – total inventory increased by 38 percent year-on-year as of June 2019 alone – the pace of the addition of new inventory has slowed as it climbs towards saturation point. The instant book trend has proven to be a great tool to combat market saturation. The amount of units switching to Instant Book has grown dramatically, rising from around 1 million units in January of 2017 to 3.6 million units as of June 2019.

The feature’s popularity can be explained by its potential to improve online conversion rates. Instant Book makes the process of booking a home rental much easier and much faster. With just one click, a booking can be secured.

Why Is Instant Book So Popular?

Instant Book generates greater interest in listings, as units that are listed as instantly bookable are given better placement on Airbnb searches. Properties listed under Instant Book are viewed more, increasing the chances of conversion and therefore helping property owners to optimize utilization. Instantly bookable units can experience an increase in occupancy rates from 5.0% to as high as 20.0%.

Additionally, Instant Book allows sites like Airbnb to more effectively and efficiently bid on Google Adwords, which allows for efficient marketing spend and positive ROI. Airbnb can acquire a customer via Google Adwords and with only one click, the customer is on the site and able to immediately book a place to stay. In the original model, which uses the formal inquiry process, where the customer and the host communicate, it was easier to lose the customer earlier in the process, as the time between communicating and confirming a reservation could take up to several days. The original model therefore has a much higher slippage rate – the communication with the host delays the closing of the transaction, and results in the customer potentially going somewhere else.

For travelers looking for a place to stay, there’s the option to filter the site just for Instant Book properties. This means that if you’re a traveler in need of finding a place immediately, this is the go-to filter. Consequently, Airbnb is offering a similar service to traditional OTAs, where customers can secure a place to stay immediately.

In the past years, there has been an overwhelming trend in the industry of a shift toward mobile usage. Travelers are using their mobile device, whether through an app or a phone’s browser, to book their next stay when they are on the go. We are living in a culture of immediate gratification and the Instant Book feature caters to this. It skips the formal inquiry process, and helps save precious time: guests can spend more time planning their trip instead of being involved in a thread of messages with the owner. In turn, this also saves the host time as they don’t have to respond to each booking individually.

Guests Versus Hosts

For some hosts, Instant Book is a contentious topic, with a section of property owners feeling that it favors guests, rather than the hosts. For example, the host loses control of their calendar and cancellations. However, there are ways to maintain control of the host calendar, such as to introduce a minimum amount of night’s stay. On the plus side, moving away from the traditional model of a formal inquiry process means that the interest of a traveler might not be lost during the messaging process.

Crowding Out The Market

Because of Airbnb’s decision to up-rank properties listed under Instant Book, many homeowners may be tempted to advertise their property as instantly bookable. This positions Airbnb in a place to crowd out the market – if a property owner is listing their place on Airbnb as instantly bookable, they can’t be instantly bookable on other vacation rental sites. Homeowners will have to choose between being instantly bookable on Airbnb or listing on more traditional sites. In turn, if the Instant Book feature proves to increase conversion rates, more and more homeowners will be keen to turn their backs on traditional OTA sites and add their property to Airbnb, listing it as instantly bookable.

What's Next?

It is undeniable that the instant book trend has been a huge success for Airbnb. Not only have they converted more than half of their total inventory to the feature, they are also in a position to crowd the market, increasing the possibility that property owners will move away from traditional OTAs and add to the already booming Airbnb inventory.

Airbnb IPO/Direct Listing Plans

Recently, Airbnb announced its plans to go public in 2020. While the fine details are yet to be announced, the company made official its intention of an initial public offering (IPO) with a public announcement on September 19, 2019. It has now been suggested by sources reporting to Bloomberg that Airbnb is preparing itself for a direct listing, instead of an IPO.

Airbnb joins the list of the big unicorn companies, or billion-dollar start-ups, such as Uber, Postmates, and The We Company which were founded around a decade ago and have recently declared their intentions to enter the public market.

Public Announcement

The company publicly announced its decision to go public on its blog, which stated:

“Airbnb, Inc. announced today that it expects to become a publicly-traded company during 2020.”

However, as of March 2020, it looks likely that Airbnb going public won’t happen until later in 2020 or 2021, as financial markets react to the outbreak and spread of the Coronavirus crisis.

Calls To Go Public

Working for one of the most successful travel companies of all time should surely have its perks, right? However, for years Airbnb’s workforce has become increasingly disillusioned by the fact that they haven’t been able to cash in on the company’s stocks, of which many workers have historically received in their compensation packages. As Airbnb is a privately-owned company, it’s not that easy for workers to sell or trade shares.

There are 6,000 people working for Airbnb at present, across over 30 offices around the world. Calls for the company to go public have been in the air for years. The recent Airbnb IPO announcement was likely influenced by calls from staff to be able to cash-in on their shares.

The staff that have been with the company since 2008 have been holding on to their shares the whole time, which is a very long time to be waiting to cash-in. In the company’s early stages, Airbnb paid its employees partly in grants of stock options, which allow them to buy shares in the company at a low price.

Direct Listing?

It’s been suggested that while Airbnb has announced its plans to go public, there’s a high chance that it will opt for a direct listing, following in Spotify’s footsteps (the music firm did the same thing in 2018). In which case, the chance of the company issuing new shares would be slim, and could, therefore, avoid high bank charges that come hand-in-hand with the issuance of new shares.

With a direct listing, companies usually do not create any new shares, and only existing, outstanding shares are sold.

After opting for a direct listing, Airbnb could then open to the public for trading. Airbnb self-declared that it has generated over one billion USD in the second quarter of 2019 (although hasn’t stated whether this was profitable). For the company, now seems like a good time to go public.

Benefits Of A Direct Listing

With a direct listing, it’s likely Airbnb would not introduce new shares and would therefore be able to reduce the amount that they pay in underwriting fees to investment banks. It would leave the decision of the share price to fall into the hands of the market.

If Airbnb opts for a direct listing, they would not fall under the rules of an IPO, whereby the company would have to reveal its finances to investors.

Success & Growth

So far, Airbnb has been enormously successful, with around 150 million users and impressive global statistics that, as of August 2019, include a gross revenue of $4,308,726,681, year-on-year growth of 21%, and a current property count of 6,370,563 listings across 191 countries.

From the platform’s success, market analysts are said to believe Airbnb might receive a warmer welcome from investors than the Uber or Lyft IPO, which both haven’t lived up to expectations and demonstrated a clear path of profitability.

When?

The company has not offered a timeline further than that it will start its Initial Public Offering “during 2020”.

Airbnb has not yet clarified whether it has confidentially filed its S-1 IPO paperwork, which is the financial information potential investors are keen to see.

Selling Shares

If a company opts for a direct listing, its employees that are looking to cash in on the shares can do so, without being tied into a lock-up period. This would mean that Airbnb employees would be able to sell their shares quickly without having to wait.

So, What's To Come?

Potential investors and the travel industry will be waiting to see what follows. While the company has had impressive growth, reporting one billion in revenue in the second quarter of 2019, Airbnb’s continued success depends on several factors.

The most prominent of these being the company’s battles with cities and destinations around the world that are trying to clamp down on the short-term vacation rental industry, which is said to be causing inflation and impacting local long-term housing prices.

The company will be up against more and more rules, with some of the most popular vacation destinations in the US, such as San Francisco and New York already taking a stand and enforcing strict rules. San Francisco has already passed a law requiring Airbnb hosts to register with the city and to be the primary resident of the unit they are renting out, causing a significant drop in listings in the area. As for New York City, there’s a strict rule in place whereby it’s almost entirely illegal under New York City law for entire apartments to be rented on a short-term basis, defined as less than 30 days.

With more and more cities tightening up their short-term rental and Airbnb-related regulations, it’s to be seen how Airbnb will continue to grow if more and more clampdowns follow in the following years.

However, for now, there’s thousands of Airbnb staff who are happy to know the chance to cash in could be on the horizon.